Gojek a Case Study in Business and Impact Affected Regulation

Foreign Ownership in GOJEK

Established in 2010, Gojek a ride-hailing tech company has successfully become one of unicorn startups whose valuation exceeds 1 billion USD in Indonesia. Although its main service is in providing ride-hailing services to its passengers, Gojek is not a transportation company, therefore it is not (yet) considered as a subject to the Government Regulation (Presidential Regulation No. 44/ 2016), that governs percentage of foreign ownership in a land transportation company must be at maximum of 49%.

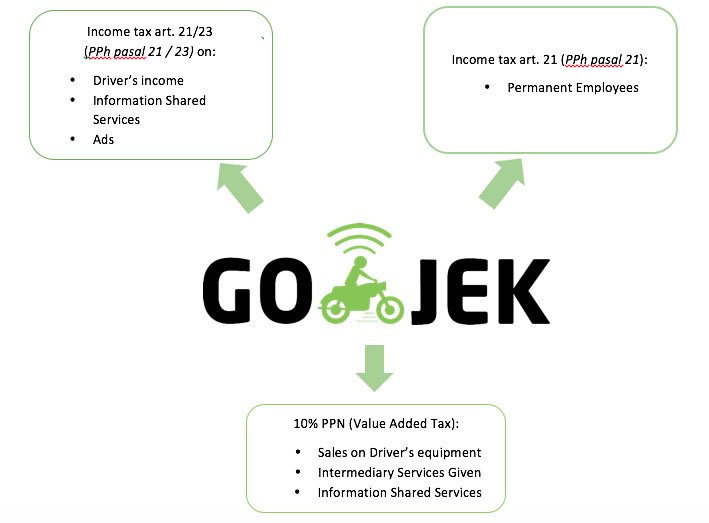

Taxation

There are 2 (two) types of main taxation imposed in a business:

1. VAT ( Value Added Tax ), being imposed on basic transaction

2. PPh ( Income Tax ), being imposed on income received

Based on GOJEK financial statement, the company still shows net loss, hence it has not yet obligated to pay any income tax which is also known as PPh article 25/29 Pajak Penghasilan pasal 25 atau 29. However as a corporate tax payer, GOJEK has the obligation to withhold the income tax imposed on any payments made to its employees, known as PPh article 21 Pajak Penghasilan Pasal 21, which is also being imposed to other third parties involved.

GOJEK Drivers however are not employees of the company, they are considered as partners, since there are no permanent element of salary and wages given; Drivers only receive a percentage based of a commission. Not only not having no permanent element of salary and wages, GOJEK Drivers do not take orders from the company itself. Instructions and/or orders come from passengers/ customers, and the drivers themselves decide on whether or not to take the orders. In relation to the taxation self-assessment principles, GOJEK Drivers are also obligated to do their own self-assessment in term of fulfilling his/her own tax obligation.

Reflecting on the self-assessment principles, then it is of one’s own discretion to decide on whether or not to report and be 100% honest, when it comes to fulfilling our tax obligation.

Gainers vs Losers

Those who gain from GOJEK phenomenon:

- Users of GOJEK’s services, who get all benefits of GOJEK services in a relatively cheap cost.

- Drivers of GOJEK, who get to work without time constraint.

- Founders & Investors of GOJEK, who get their opportunity to scale up business

Those who lose:

- Land transportation company and non-GOJEK drivers, who could not compete against the rapid changes of the digital technology disruption and those who refuse to ride along with it.

- Banks, for losing a significant volume of transactions made by customers using GOPAY instead of using the conventional bank payments.

Regulator keeping up with the tech advancement and business changes

In response to the fast changing digital economy, “There are a non-stop feedbacks that keep coming in, while drafting the Decree of Minister of Finance Regulation (PMK)” said the Minister of Finance.

Any good regulation must be able to ensure certainty in business, as such it must also be relevant to the tech development, and at the same time, such a regulation must also be practicable, as opposed to tightening the regulation itself, therefore the Government needs to keep communicating with business and tech practitioners. Today, there are still plenty of “no-man’s-land” in law and regulations, which show the tardiness of the Regulator in keeping up with the fast-changing business realm. KADIN (The Chamber of Commerce and Industry in Indonesia) as the Government partner, must be able to voice up necessary changes in law and regulation, so as to able to respond with such business changes, including regulations changes in tax and custom.

We need all the support we can get from all national business peers and investors, i.e. APINDO and other Boards of Businesses and Investments in Indonesia to actively participate in helping the Government set the course right so as to establish, revise, and reform an improved sets of regulation.